I wrote and sent an email to Sen Josh Hawley, MO asking him to support the Build Back Better Act especially the parts that support children.

There are programs and funding in the act to provide federal money to states to upgrade/support existing K-12 public schools. Missouri currently comes in at 47th in education spending, is known for it’s school to prison pipeline because our public schools are underfunded and under-supported. Additionally there is funding for childcare providers to get back on their feet, to develop a free pre-school program and to provide other resources for early childhood. These funds would get child care up and going again so that workers can return to work. I know there may be stuff in the ACT that may be political pork, but anything that is going to help the children in the United States to get the care and education they deserve (and should expect in the wealthiest nation in the world) is good IF WE ARE PRIORITIZING CHILDREN like we should be doing.

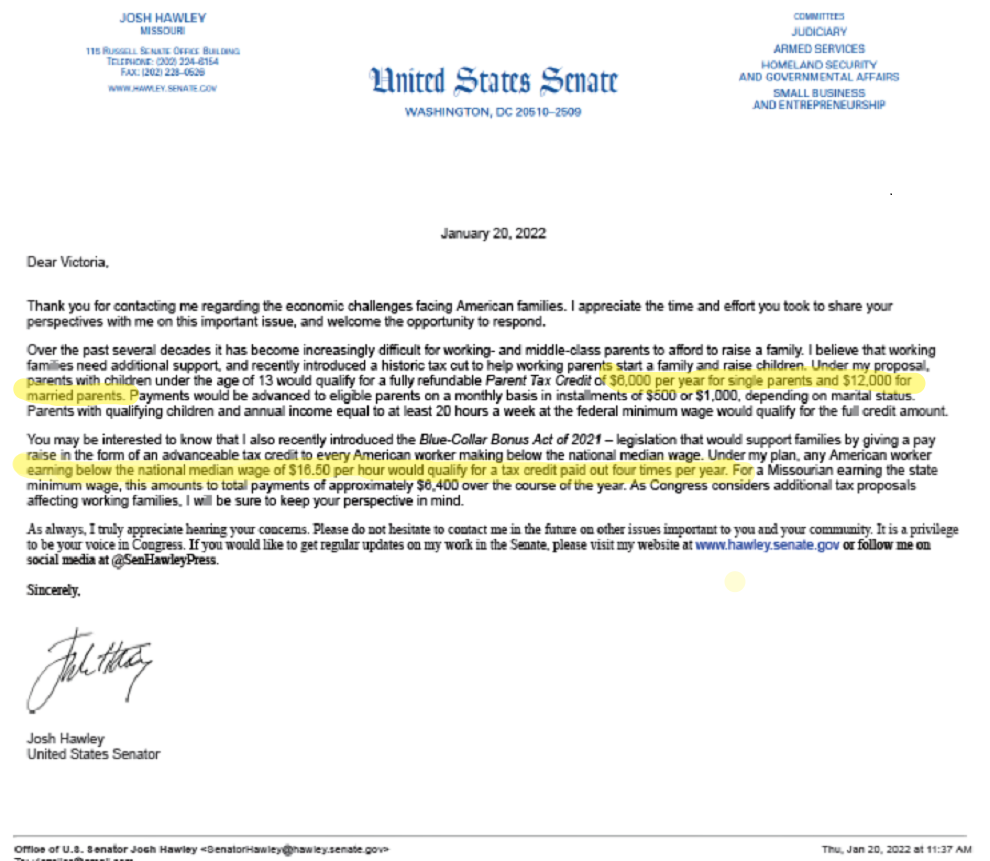

I received the following response from Sen. Hawley:

I do not understand why the parents marital state has anything to do with how much is needed to take care of a child.

So anyone making $16.50 or more isn’t blue-collar enough?

I went to the https://www.congress.gov/ and looked at the bills he mentioned.

S.1426-Introduced in Senate (04/28/2021) Parent Tax Credit Act

This bill allows an eligible individual a tax credit of $6,000 ($12,000 in the case of a joint tax return), with a limitation based on a minimum earned income level. The bill defines eligible individual as any individual who has a qualifying child who is not yet 13. The eligible individual may not be a nonresident alien, any alien unlawfully present in the United States, and any individual who is a dependent of another taxpayer. To be eligible for the credit, the taxpayer must include on the return of tax a valid Social Security account number.

The bill requires the Internal Revenue Service to establish a program for making advance payments of the credit to taxpayers on a monthly basis.

The bill terminates the child and dependent care tax credit after 2021. https://www.congress.gov/bill/117th-congress/senate-bill/1426?q=%7B%22search%22%3A%5B%221426%22%2C%221426%22%5D%7D&s=1&r=3

So this bill was supposed to replace the Child Care Tax credit that lapsed at the end of December. So is 13 the age limit for parents to be financially responsible for their child? The credit is at the individual tax payer level so it doesn’t matter how many children the tax payer has they get the same amount if they have 1 or 6.

S.536 – Introduced in Senate (03/02/2021) Blue Collar Bonus Act of 2021

This bill allows a refundable income tax credit to supplement wages received by an individual taxpayer that are less than the median wage. The bill defines median wage as $16.50 per hour, increased by annual inflation adjustments beginning after 2021. The bill also provides for advance payments of the credit.

The bill requires taxpayers to provide their Social Security account numbers on their tax returns to be eligible for the credit. The credit expires after 2023. https://www.congress.gov/bill/117th-congress/senate-bill/536?q=%7B%22search%22%3A%5B%22Blue+Collar%22%2C%22Blue%22%2C%22Collar%22%5D%7D&s=1&r=1

This appears to be a short term bill only lasting through 2023. The wording of this sentence in the summary caught my attention “The bill defines median wage as $16.50 per hour,“. In his email response Senator Hawley makes it sound like there is no question that the median wage is in fact, $16.50 an hour. But the summary wording made me wonder so I checked it out the U.S. BUREAU OF LABOR STATISTICS lists a lot of different industries with the median hourly wage and the lowest one is currently $19.57. However, per Statista – In October 2021, the average hourly earnings of all employees in the United States was at $11.19 U.S. dollars. Maybe he looked at the data on Governing Magazines site that showed Missouri median wage in 2017 to be $16.46. If the U.S. BUREAU OF LABOR STATISTICS is right not many workers would benefit from this bill, if Statista is right a lot or workers would.

MY TAKE

On the surface having these two bills showing up as being submitted and sponsored by Josh Hawley makes it look like he is trying to represent the working class constituents in Missouri. Both bills were introduced early last year while in the middle of a pandemic, both bills fundamentally miss the mark on prioritizing children and helping families out of poverty. Neither bill has made any progress, he has no co-sponsors. The parent tax credit act makes absolutely no sense to me since it excludes any child 13 and older, pays less for a single parent who is more likely to need the help and pays the same amount no matter how many children the parent is raising.

Link to BBBA information: https://www.congress.gov/bill/117th-congress/house-bill/5376/text

TITLE II–COMMITTEE ON EDUCATION AND LABOR Subtitle A–Education Matters PART 1–ELEMENTARY AND SECONDARY EDUCATION

SEC. 23001. BIRTH THROUGH FIVE CHILD CARE AND EARLY LEARNING ENTITLEMENT.

OTHER LINKS OF INTEREST

https://www.bls.gov/news.release/empsit.t19.htm Average hourly and weekly earnings of all employees on private nonfarm payrolls by industry sector, seasonally adjusted – U.S. BUREAU OF LABOR STATISTICS

https://www.governing.com/archive/wage-average-median-pay-data-for-states.html